Pines Pipe Update

Controversial Decision To Direct Staff to Draft MOA Prompts No Discussion By Commission

Let me repeat that: neither the Pinelands commission staff review or the applicant’s (South Jersey Gas Co.) presentation to the Commission even mentions air pollution, greenhouse gas emissions, or climate change impacts. ~~~ Bill Wolfe 10/7/13

[Important Updates below and in text below]

The Pinelands Commission met today – the South Jersey Gas (SJG) Pipeline project was not on the agenda.

After the Call to Order, Pledge of Allegiance, and adoption of the minutes, the various Committee Chairs reported to the Commission.

Planning and Implementation Committee Chairman Lohbauer gave a cursory brief of the prior meeting.

He informed the Commission that SJG presented their project; that 36 people spoke at the hearing; that SJG was preparing responses to questions posed by the Commission and the public; and then casually mentioned that he directed staff to draft a Memorandum of Agreement (MOA) for the Commission’s consideration.

Lohbauer mentioned the MOA issue in passing, as if it were a minor technical detail, instead of a huge policy step in further cementing the Commission into a controversial and questionably legal track in approving the pipeline.

There was no discussion on Lohbauer’s seemingly unilateral decision to direct staff to draft a MOA – or on the decision to even consider a MOA – or whether a MOA was legally valid in this case.

Did the Commission authorize Lohbauer to direct the staff to draft a MOA? If so how? Straw vote? Formal vote? Abuse of Executive Session? Or by smoke signals?

Or did Lohbauer make this decision on his own?

[Update: Or did Director Wittenberg issue marching orders from the Gov. via DEP Commissioner Bob Martin- which is her role.]

Is anyone even concerned about all this?

There was no discussion of my prior recommendations that the Commission was on thin legal ice in negotiating a MOA for a private speculative investment or that the Commission lacked ANY science based criteria, standards, or review Guidance to evaluate a MOA and determine “equivalent” level of protection, the key finding that must be made by the Commission to waive CMP requirements via a MOA.

All of these issues were completely ignored by the Commission- at least in public discussion.

Several project opponents attended and spoke to urge the Commission to enforce the Comprehensive Management Plan, do the right thing, and reject the pipeline proposal.

“Don’t Gas the Pinelands Coalition”, the Pinelands Preservation Alliance, and Sierra Club opponents advised the Commission that there are 44 groups signed on to a letter opposing the project. Commission members, staff, and the public were invited to attend a presentation by Kevin Heatley, a restoration ecologist (details forthcoming – October 16th 7 pm, see this for details of that important meeting!)

I spoke and basically reiterated prior testimony.

I emphasized that it was premature to even consider a MOA at this time, and again urged the Commision to:

- direct Counselor Roth – in consultation with the Attorney General’s Office – to render a written legal opinion as to whether the Commission has jurisdiction and authority under the Pinelands Act, the CMP, or implementing regulations to review the pipeline with respect to climate change and air quality impacts and, if authorized, the parameters of that review;

- direct staff to consider the best available science on climate change impacts on forest ecosystems, including recent and ongoing US Forest Service science; and the nexus between those impacts and the direct, indirect, and secondary impacts from the proposed pipeline and the BL England power plant it is designed to serve; (as I wrote:

The Pinelands have become a case study on forest ecosystem impacts of climate change, see: Effects of Climatic Variability and Change on Forest Ecosystems: A Comprehensive Science Synthesis for the U.S. Forest Sector –

In that assessment, the Pinelands impacts are presented as a case study, see: The Southern Pine Beetle Reaches New Jersey Pinelands – Box 2.3 – p.19).

The US Forest Service is working on and will soon release more research on climate change impacts on pines forests. US Forest Service is about to release this research report:

Title: Climate Change and Carbon and Nitrogen Dynamics in the NJ Pine Barrens

We are assessing the interactive effects of fire management and insect defoliation on tree species composition, carbon, and nitrogen dynamics in the New Jersey Pine Barrens. We are determininghow interactions among these disturbances affect management goals. Our goal is to create a framework for understanding landscape to regional management scenarios in areas with multiple, interacting management priorities that can be applied across the US. We use then use this framework to project future changes and may be caused by climate change or changes in fire management policy.

- direct staff to develop science based policies, criteria, standards, methodology, and technical review Guidance for determining “equivalent” level of protection for the purposes of structuring the review of a MOA; and

- procure independent consultant expertise to supplement staff expertise and fill gaps in staff expertise with respect to pipeline review.

I advised the Commission that Counselor Roth’s April 12, 2013 statements in support of a MOA and the subsequent BPU June 21, 2013 Order’s inclusion of a MOA with the Commission create a reasonable perception that this is a done deal and that the project will not be independently reviewed on the basis of science, law, and the public interest, in consideration of strongly negative public comments and public sentiments expressed at numerous hearings so far.

At this point, the MOA issues, in light of the SJG presentation and the extensive 18 months review history between SJG and staff, compounded by the failure by the Commission to openly discuss any of the above recommendations in public, are deeply troubling.

I closed with a warning that the Commission lacks a defensible scientific and legal basis to approve or reject a MOA.

I told the Commission that in light of this vulnerability, it was premature to proceed with a MOA and that the Commission should shelve the MOA process until the above recommendations are implemented and the various issues clarified in writing.

I got no indication whatsoever that my advise was being considered.

More to follow.

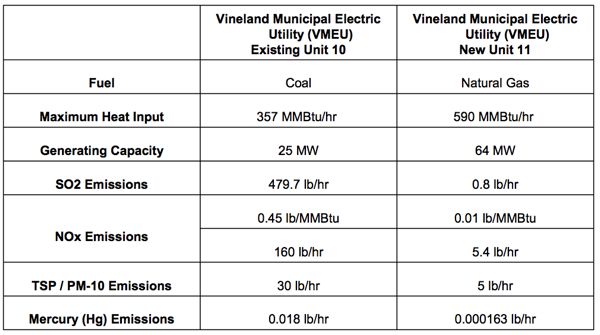

[Update – I left out one important point I made to the Commission. I told them that BL England was under a “go – no go” decision and notice by December 2013 under the DEP ACO. I warned the Commission that it appeared as if this deadline was driving the review process. In fact, prior minutes and a prior presentation by Counselor Roth specifically highlighted the DEP ACO deadlines and spoke about a tight schedule (see this briefing by Ms. Roth on June 28, 2013 minutes)

There are rapidly approaching deadlines including RC Cape May Holdings determination by May 1, 2014 that it will indeed repower the plant or face complete cessation of operations of the coal fired units. Unless repowered, the Amended Administrative Consent Order (AACO) with the DEP requires the complete shut down of the 2 coal fired units by September 30, 2013 and May 1, 2014, respectively.

I warned that if the SJG pipeline is approved before then and after the election, then it will be obvious that that deadline was the reason the project review was expedited and that the Commission did not get develop a nexus between law and science on climate change; procure independent expert consulting assistance; and develop the necessary standards regarding “equivalent level of protection” under a MOA, as I have repeatedly recommended.

As I was saying this, Director Wittenberg repeatedly shook her head “no” and even spoke the words “no” – at which point I clarified that on the record that Wittenberg specifically disputed and rejected my concern about this deadline and timing of approval. – end update]